Of all insurance applications, continuation options are the most straightforward. This is due to health factors being disregarded in the assessment process, which are usually the most common reason for processing times being extended.

Processing Your Application

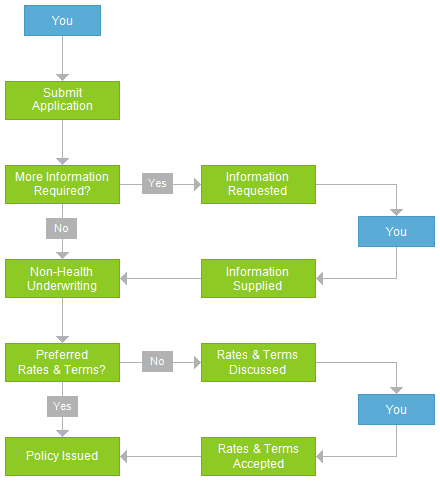

Your Application goes through initial processing as soon as it is submitted. This is to check that there is no missing or incomplete information which would prevent it from being fully assessed. If any further information was required then we would contact you for that.

Following initial processing, your Application is assessed in the underwriting stage for all non-health factors. These consist of your occupation, any hazardous pursuits or activities which you engage in, any plans you have for overseas travel and your residency status. Your Application is then accepted at preferred premium rates and without any exclusions which are specific to you, or if that is not the case (which is quite uncommon), the acceptance terms are discussed with you.

If the cover you had under your workplace insurance plan was subject to a premium loading or an exclusion which was specific to you, then the same premium loading or specified exclusion is carried over to the individual policy which you take out with your continuation option. However, sometimes a workplace insurance premium loading or a specified exclusion only applies to cover in excess of a certain amount (such as cover which is above an automatic acceptance level), and where this occurs the premium loading or specified exclusion will only be applied to cover above that amount under the individual insurance policy.

The application process can be illustrated as follows:

For more information on the application process, please see the Continuation Option FAQs.